Colgate is a diversified consumer products company that operates globally in two main segments: Oral, Personal and Home Care; and Pet Nutrition. The company has established a strong market presence in these areas, leveraging its brand strength and extensive product portfolio.

In the Oral Care segment, it occupies a significant market position, especially in the toothpaste, toothbrush and mouthwashes categories. Colgate's success in Oral Care is also bolstered by its pharmaceutical products, which are tailored for dentists and oral health professionals.

In the Personal Care market, the group demonstrates leadership across multiple categories, with a particular emphasis on liquid hand soap. Its personal care products include hand soaps, bar soaps, shower gels, deodorants, antiperspirants, and skin health products, as well as shampoos and conditioners.

Colgate's presence in the Home Care market is marked by its production and marketing of various products, including dishwashing liquids and household cleaners. The company has also established a strong foothold in the fabric conditioner segment, particularly in regions like Latin America, Europe, and the South Pacific.

The Pet Nutrition segment, operated under the Hill’s Pet Nutrition brand, positions Colgate as a world leader in specialty pet nutrition products for dogs and cats. Hill’s markets its products in over 80 countries and territories worldwide, with two primary brands: Hill’s Science Diet (also known as Hill’s Science Plan in Europe) for everyday nutritional needs, and Hill’s Prescription Diet for therapeutic pet foods.

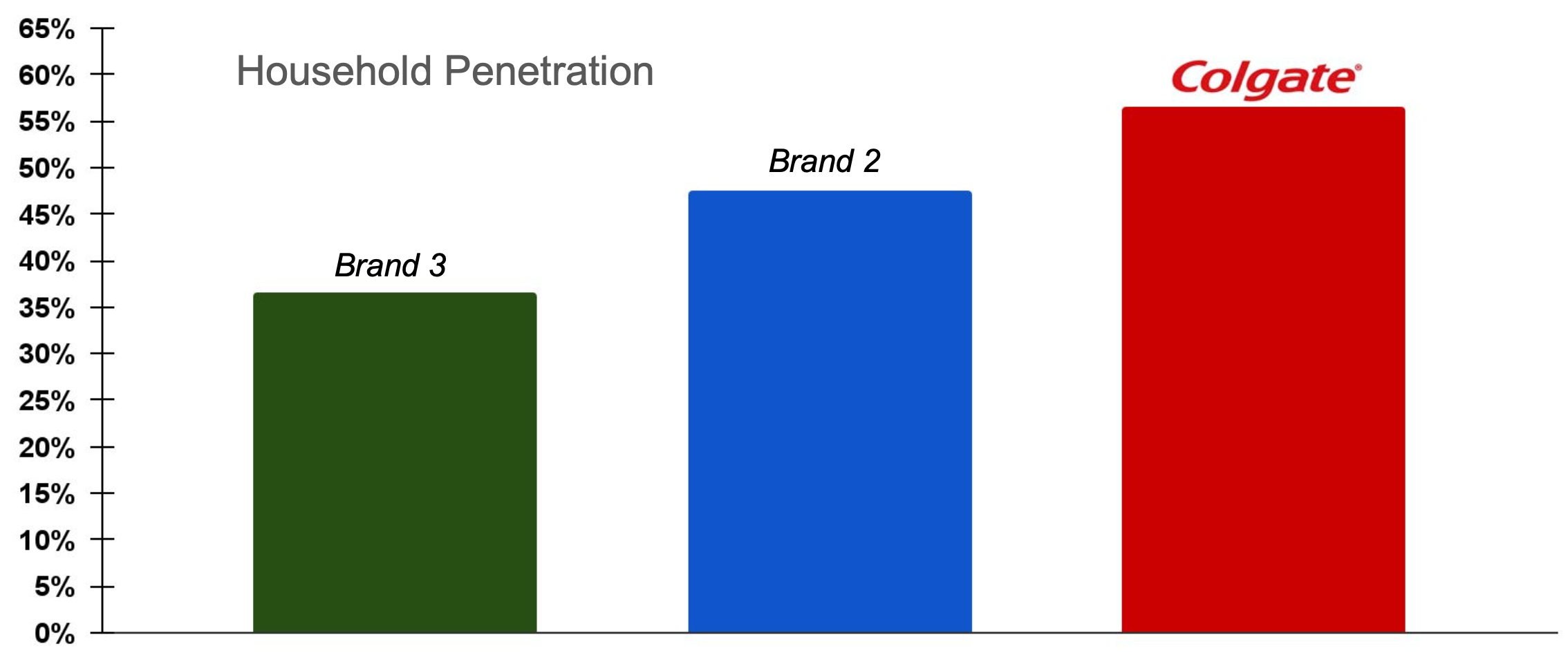

So, the company is rather ubiquitous, and chances are you have some of their products in your home. One of its strengths is high household penetration, which is approximately 55%, notably higher than its second and third competitors, who have penetration rates of 45% and 35%, respectively.

As previously mentioned regarding the company's product portfolio, Colgate strategically introduced a "higher quality" product line a few years ago, tailored to both everyday consumers and professionals. This range, known as "chair to sink whitening," encompasses three categories: everyday use, at-home treatments, and professional products. Available in 55 countries, including 10 in Asia, 33 in Europe, and 12 in Africa/Eurasia, this product line has become a key growth driver for the business.

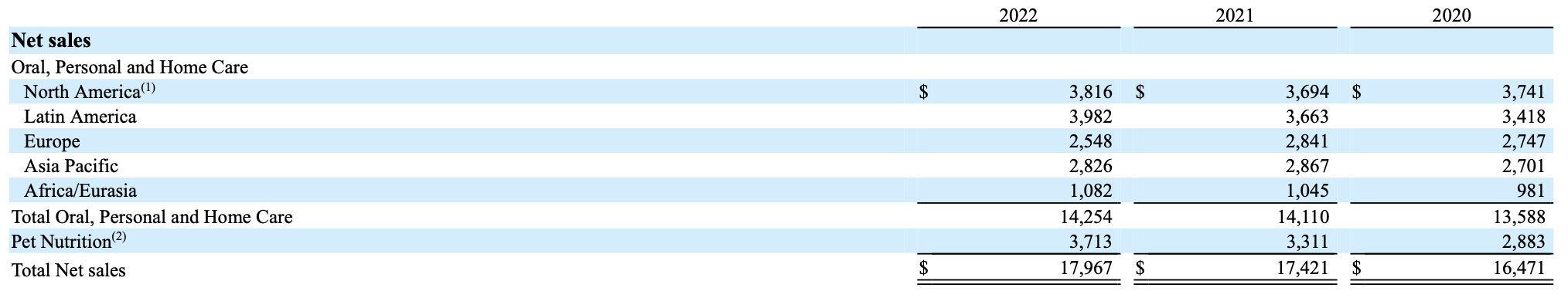

Approximately two-thirds of the Company's net sales are generated from international markets, with around 45% originating from emerging markets, including Latin America, Asia (excluding Japan), Africa/Eurasia, and Central Europe. This geographical diversification helps mitigate reliance on any single country.

Sales to Walmart and its affiliates account for a notable portion of the company's Net sales, representing approximately 11%, 12%, and 12% in 2022, 2021, and 2020, respectively. No other customer contributed more than 10% of net sales in the periods presented.

The distribution of the company's net sales across different product categories in 2022 shows that Oral, Personal and Home Care products constituted 43%, 19%, and 17%, respectively, of total worldwide Net sales. Oral Care is particularly prominent in the Asia Pacific region, accounting for about 82% of Net sales there in 2022. Additionally, sales from Pet Nutrition products made up 21% of Colgate's total worldwide Net sales in 2022.

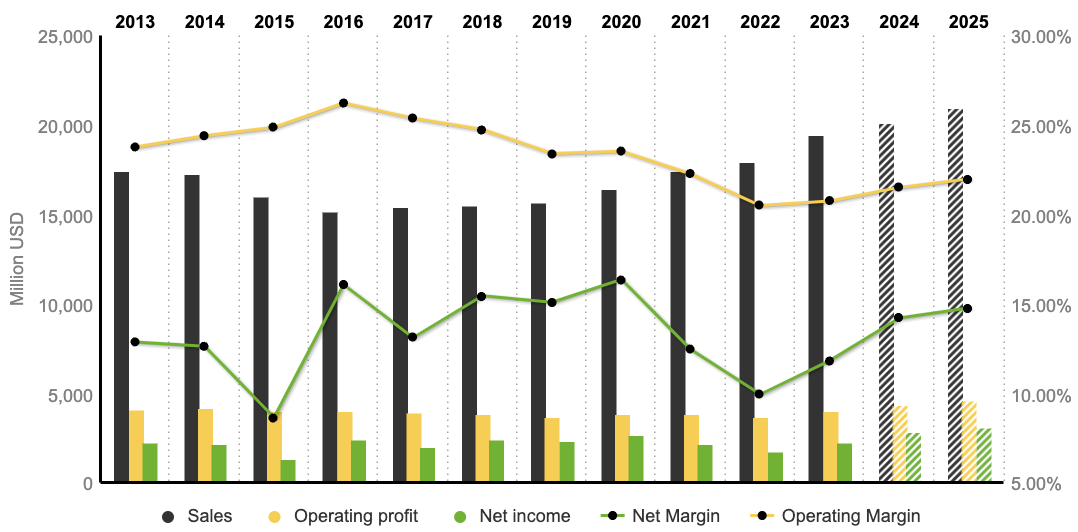

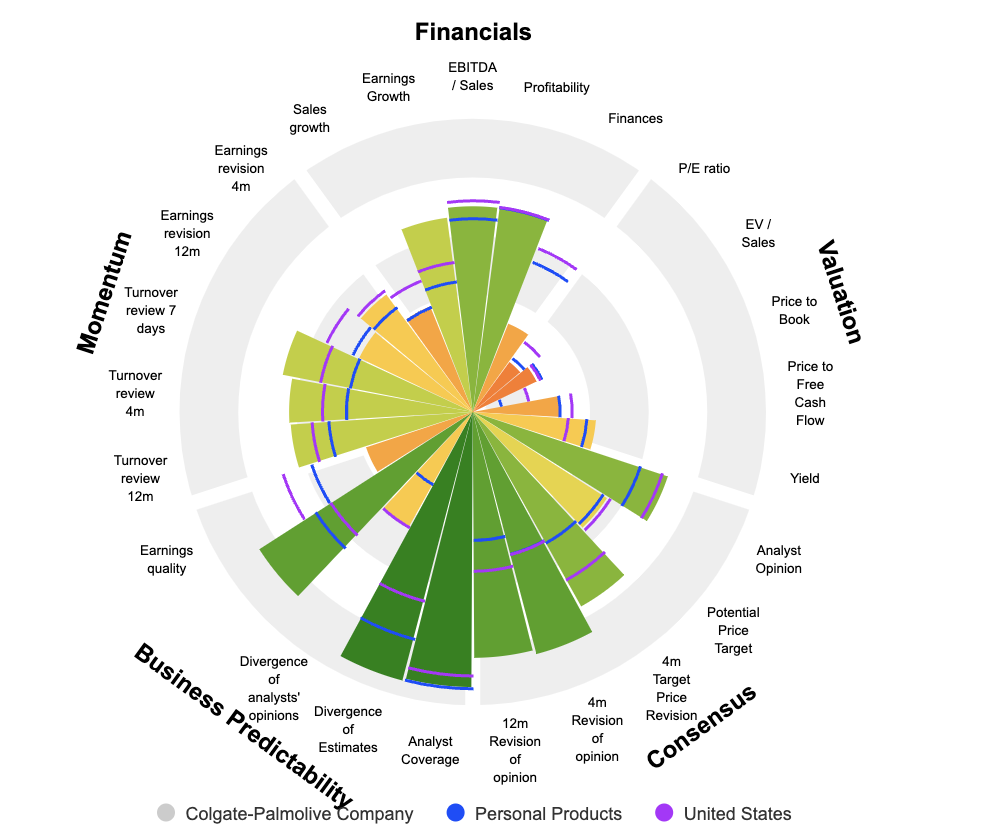

Examining the recent performance of the company provides valuable insights into its growth trajectory. In the last quarter, Colgate generated $4.9 billions in net sales, demonstrating a notable year-over-year increase from $4.6 billion. This surge in revenue signifies enhanced profitability with operating up from 20.33% during 2022 Q4 to 21.7% for 2023 Q4, indicating a positive growth trend.

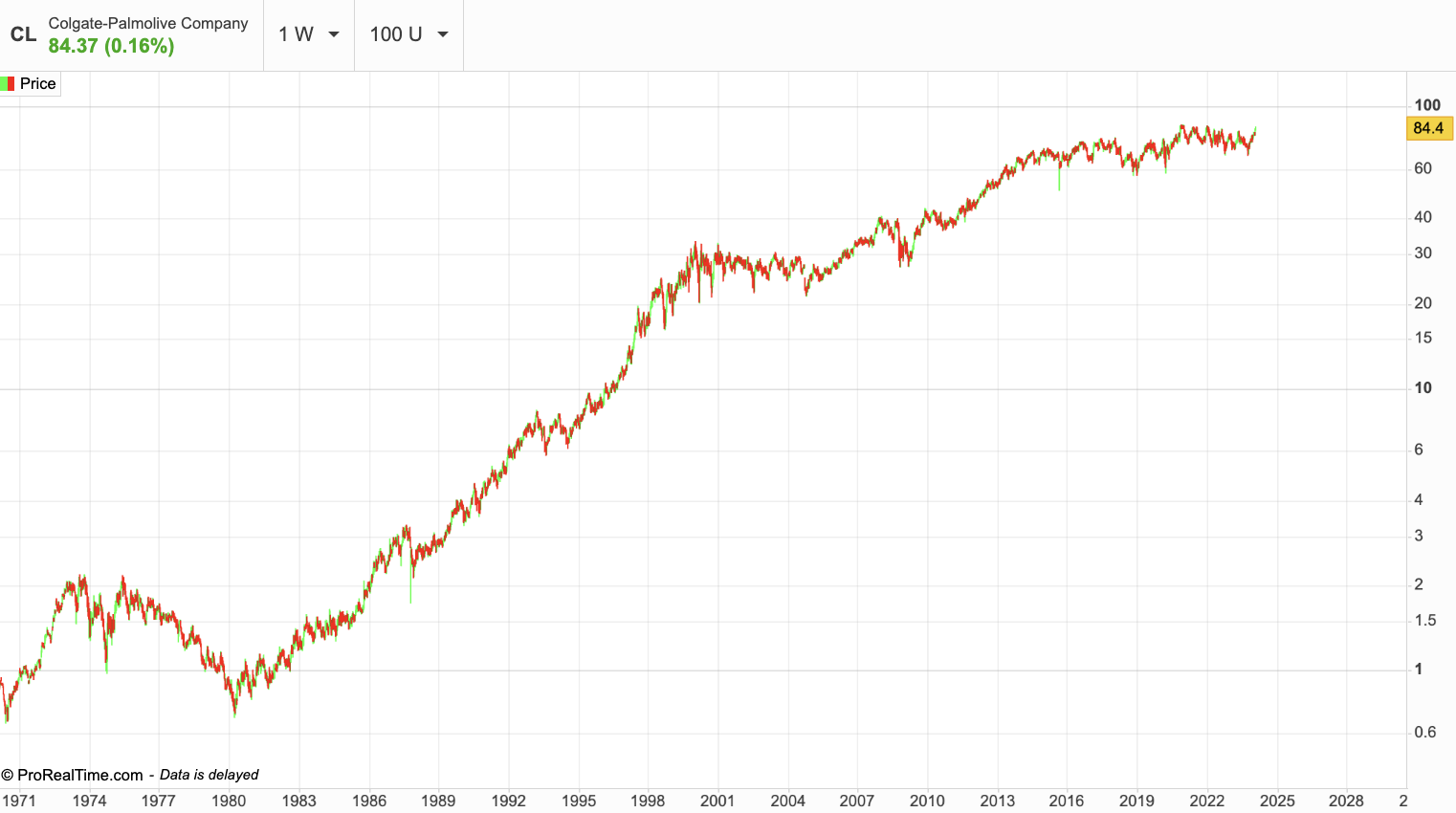

It's important to note that it’s a resilient stock where revenues don’t have exponential growth as we can see with the EBITDA that grow from 4.579 billion to 4.603 billion in 2023 which correspond to a CAGR of 0.04%

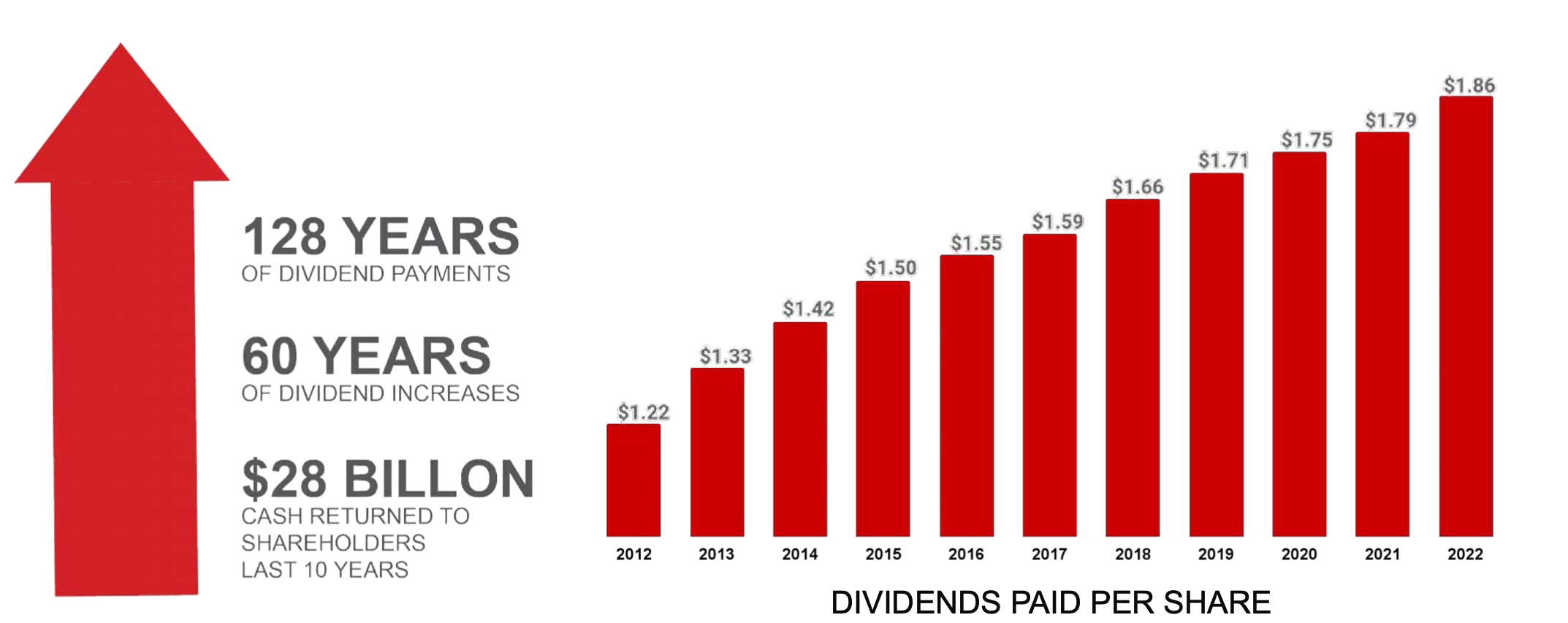

The dividend payout is a crucial aspect of Colgate’s financial strategy. Over the period from 2012 to 2022, the dividend has seen consistent growth, escalating from $1.22 to $1.86, reflecting a 52% increase. At the same time, it’s been 128 years that the company has been distributed dividend and an increasing one for 60 years making the company part of the close list of Dividend Kings.

Innovation and distribution are at core of the company. To stay competitive and always increase their number of customer Colgate invested $320 million in 2022 in R&D and close to $2 billion in advertising. This can be explains by the launch of new product as well as the expansion of existed products in different countries and therefore require advertising to make the product/brand known.

Colgate faces significant competition in the global market, both from local businesses and larger multinational corporations (Procter & Gamble; Johnson & Johnson, Unilever, Kimberly-Clark) some of which have greater resources. The rise of eCommerce (Amazon, Etsy…) has also brought in new competitors and business models. The company competes in areas such as pricing, promotions, product innovation, and expansion into new markets and channels.

The group is facing challenges due to its high level of leverage, and its bottom line is being impacted by operating expenses, despite increasing sales. It is experiencing growing competition in its industry, which could pose long-term challenges. Its current P/E ratio stands at 28.8x, indicating a relatively high valuation compared to its earnings. However, the stock has shown resilience and offers attractive dividend yields.

Google

Google

Apple

Apple

By

By