Last week, the dollar took advantage of the Fed's stance and the good performance of the US job market. The release of any macroeconomic data in favor of maintaining key rates at their current level will be beneficial to the greenback. As a result, the dollar index (DXY) has just broken out of a congestion zone by breaking above 103.70, paving the way for a further recovery to 104.80 or even 105.75/88.

The same applies to commodity currencies. The aussie continues to weaken towards 0.6437 and even 0.6294, with initial resistance at 0.6610, while the kiwi is heading for 0.6028, with the next target at 0.5882 and initial resistance at 0.6144 (at close).

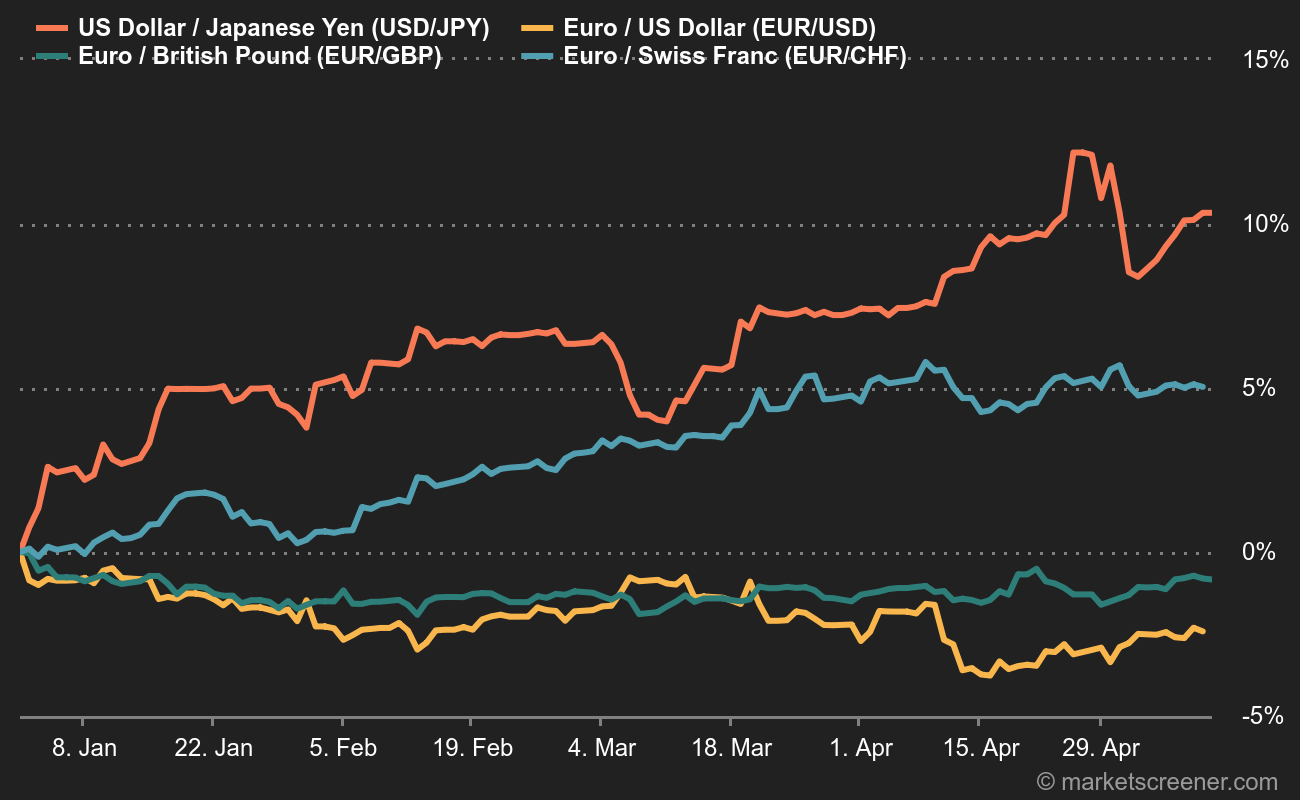

The yen remains weak against all other G10 currencies, notably CHF, due to the continuation of ultra-accommodative monetary policy. Resistance at 148.15 has been breached, paving the way for further recovery towards 151.65. We'll be watching 146.46 for initial support.

The dollar is also strengthening against the scandies. The USDSEK is continuing its advance towards 11.02/19 and is currently testing initial resistance at 10.59. As for USDNOK, the breakout above 10.60 suggests more ambitious targets at 11 and 11.217, with initial support at 10.43.

Google

Google

Apple

Apple

By

By