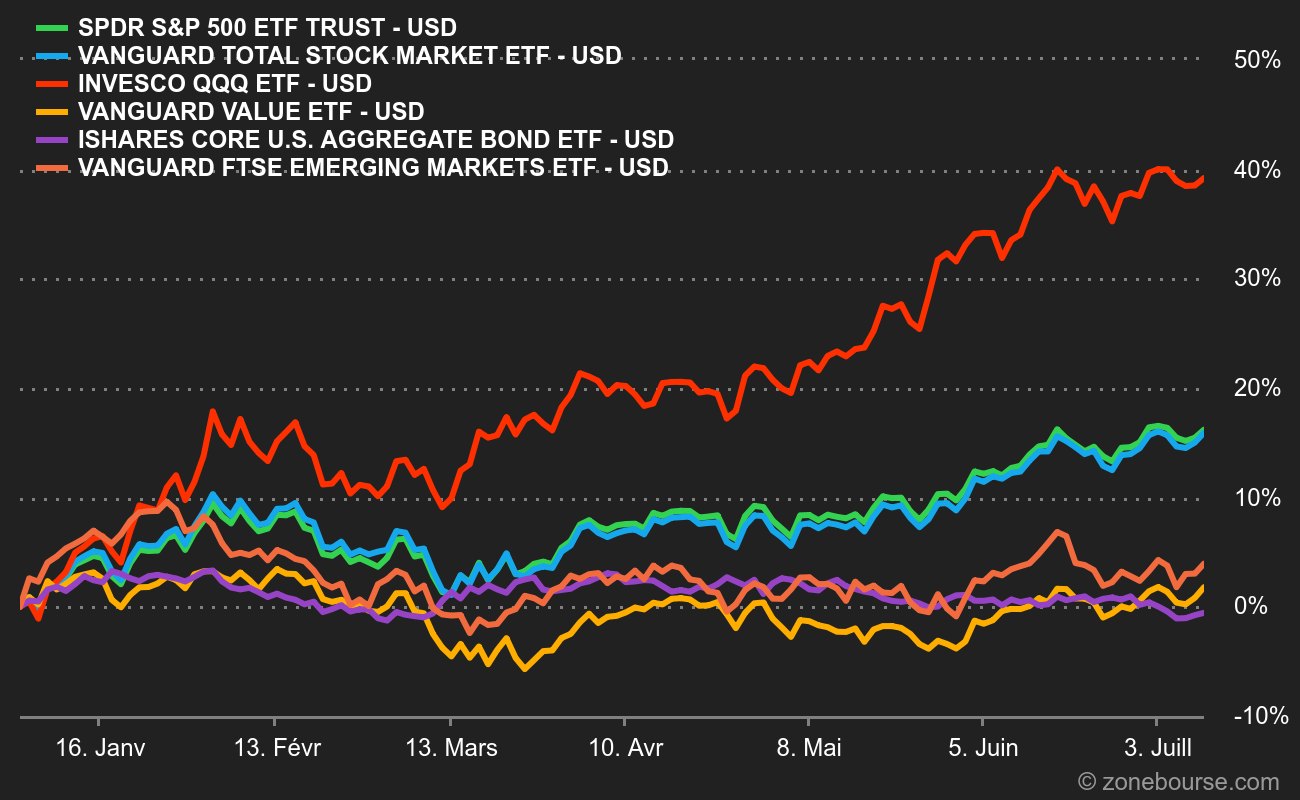

A "special rebalancing" of the Nasdaq 100 index is scheduled for later this month, as the operator of the US technology index works to reduce concentration in favor of very large caps. The Nasdaq 100 has recovered 38% since the start of the year, a meteoric rise that has been underpinned by a handful of leading stocks. Microsoft, Apple, Nvidia, Amazon and Tesla together account for 43.8% of the index's weight, according to Refinitiv data at Monday's close. As part of the rebalancing, this weighting will be reduced to 38.5%.

"There is concern that this handful of names could disrupt the health of the stock market as a whole, which is probably the reason for the special rebalancing," said Art Hogan, chief market strategist at B Riley Wealth. The adjustment will be based on shares outstanding as of July 3. The announcement of the changes is expected on July 14, to take effect before the market opens on July 24.

What is special rebalancing?

This is a tool available to Nasdaq to maintain compliance with a U.S. Securities and Exchange Commission rule on fund diversification. It has only been implemented twice in the past, in 1998 and 2011. Special rebalancing can be carried out at any time if the cumulative weight of companies that individually represent more than 4.5% of the index collectively exceeds 48%.

Microsoft has the highest weighting with 12.91%, followed by Apple with 12.47%, Nvidia 7.04%, Amazon 6.89% and Tesla 4.5%, according to Refinitiv data. It was the recent surge in Tesla shares that pushed the total weight above 48%, triggering the rebalancing, Wells Fargo strategists said in a note to clients. Nvidia's historic surge earlier in the year was also a factor.

And the S&P500?

Weight rebalancing in the S&P 500 takes place when a group of companies, each of which weighs more than 4.8%, exceeds 50% of the total index, according to S&P Dow Jones Indices. Apple and Microsoft are the only two companies whose weight exceeds 4.5% in the S&P 500. The five most influential companies in the S&P 500, which also include Amazon, Nvidia and Tesla, account for 22.2% of the index's total market value.

An S&P spokesperson said the company "does not generally comment on the actions of other index providers and potential changes to our indices". But clearly, the S&P500 is far from its statutory limits.

Which stocks will benefit?

Wells Fargo believes that Starbucks, Mondelez, Booking, Gilead, Intuitive Surgical, Analog Devices and Automatic Data Processing will increase their weight in the Nasdaq 100 index, while Microsoft, Apple, Nvidia, Amazon, Tesla, Meta Platforms and Alphabet' s influence in the index could diminish, according to strategists.

"Smaller companies will end up representing a larger percentage of the index as a whole," said Sam Stovall, chief strategist at CFRA Research. "This will force portfolio managers to increase their positions in these companies, driving up their share prices.

Index rebalancing to come

Apple, whose market capitalization reached $3,000 billion at the end of last month, fell 1% on Monday following this news. Other stocks of the same ilk, including Microsoft, Alphabet and Amazon, gave up 0.7% to 2.5%. The changes to the index will force investment funds that track it to adjust their portfolios and sell shares of companies whose weight in the index has been reduced. A host of funds that track the Nasdaq 100, including the well-known $200 billion Invesco QQQ ETF, are expected to be affected by the rebalancing.

Google

Google

Apple

Apple

By

By